Cloud Marketplace Trends in 2024

2024 Forecast: ISV’s Insider Look into 5 Cloud Marketplace Trends

Automation will drive cloud marketplace scaling possible

- Increased operational efficiency

Facilitate 75% faster time to market

Save 45% productivity lost due to context switching

Greater sales productivity

Preventing 46% of sales inquiries which turn into missed opportunities

Facilitating 30% higher deal closure rate with Salesforce automation

Robust reporting and insights

10% higher year-over-year revenue growth with accurate forecasts

Automation will drive cloud marketplace scaling possible

- Increased operational efficiency

Facilitate 75% faster time to market

Save 45% productivity lost due to context switching

Greater sales productivity

Preventing 46% of sales inquiries which turn into missed opportunities

Facilitating 30% higher deal closure rate with Salesforce automation

Robust reporting and insights

10% higher year-over-year revenue growth with accurate forecasts

Want to leverage the Cloud Marketplace Sales with SaaS enablement platform?

Introduction

2024 is slated to be a big year for the cloud. Anticipating a huge surge in adoption, the worldwide public cloud end-user spending is expected to reach $679 billion in 2024, as reported by Gartner. This growth, which is over a 20% increase from the previous year spending, clearly illustrates accelerating confidence among businesses about the cloud potential.

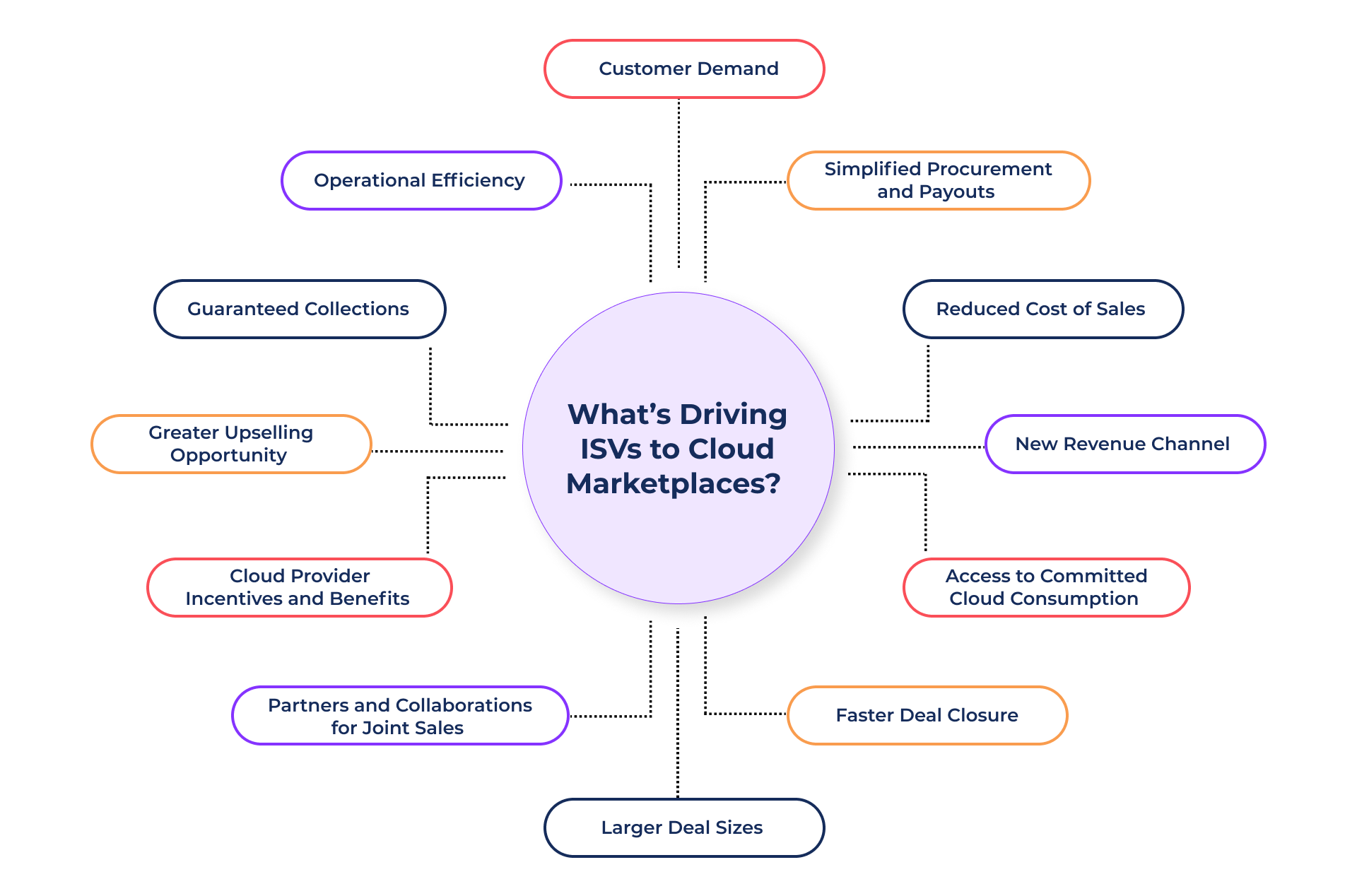

Greater cloud adoption also signals an acknowledgement and acceptance of using cloud as a potent software sales channel by both software buyers and sellers alike. Invariably, businesses making multi-million investments in the cloud have created full blown strategies to optimize their investments or ensure high return on investment. One of the ways is to navigate cloud marketplaces for buying software offerings, which comes with its own set of tangible benefits and advantages.

B2B software sales via cloud marketplaces

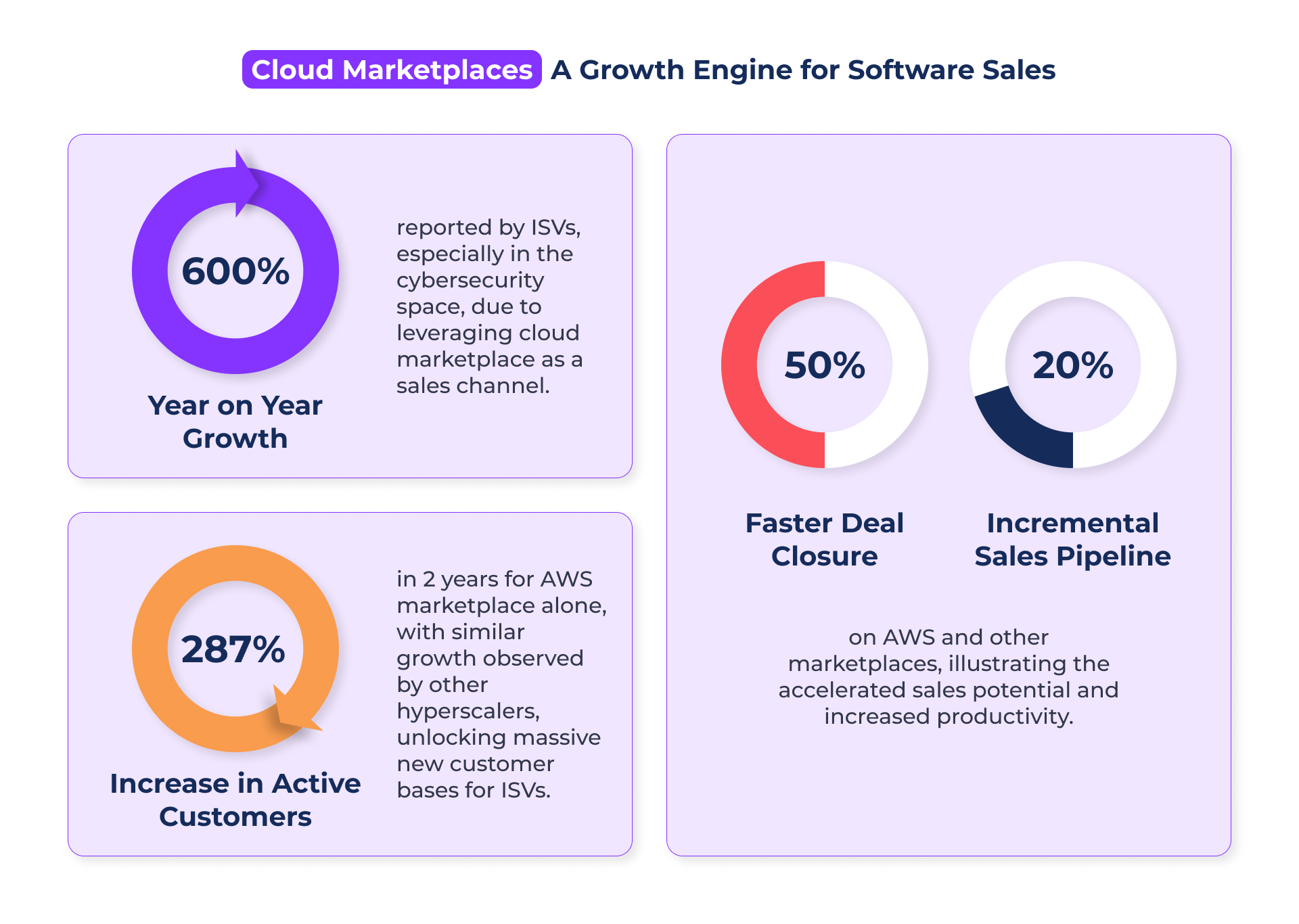

Cloud marketplaces as a sales channel will see a massive growth in momentum, both with increased number of software customers as well as higher deal sizes. In fact, its sales potential is likely to be exponentially higher than the initial estimates quoted a few years back, when cloud marketplaces were just gathering wind.

A clear mindset and strategic shift has been observed among software buyers, who are now more than willing to ‘shop’ for software on cloud marketplaces. The increased interest from software buyers, coupled with the option to access committed spends that businesses have with cloud marketplaces, create a golden intersection for ISVs. Therefore, this is an opportune moment for all ISVs to commence or accelerate their cloud marketplace journey and make it an integral part of their sales strategy, rather than just an afterthought.

In fact, 2024 is likely to be a year of unprecedented growth for ISVs selling through the cloud marketplaces. This growth stems from some of the predictions and market analysis that have come to the forefront. To help you navigate the same, SaaSify has curated this exclusive “2024 Forecast: ISV’s Insider Look into 5 Cloud Marketplace Trends”.

This whitepaper will uncover 5 major trends that will help you navigate your cloud marketplace journey for 2024 and guide you on the best practices and some inside tricks of the trade to see an exponential growth in your cloud revenue.

Cloud marketplaces will be more popular than ever:

$45 billion+ sales through cloud marketplaces by 2025

Now commonly referred to as hyperscalers due to their large data centers and the potential to serve massive number of users in the cloud, the three leading cloud marketplaces, i.e. AWS, Azure and GCP marketplace will help businesses lay and strengthen their sales foundation in 2024, owing to unparalleled and unanticipated growth.

Studies show that cloud marketplaces are expected to cross the $45 million sales mark by 2025, representing a CAGR of 84%, which is huge. In fact, this prediction has hugely surpassed the pre-pandemic estimates. This is roughly 2x of what experts predicted will be the expected cloud marketplace sales by then time this century hits a quarter. In addition to this huge sales potential, there are several other reasons which point towards cloud marketplaces becoming a game changer in 2024 for ISVs.

The forecast for cloud marketplaces as a channel for growth is further strengthened by stories of success. For instance, CrowdStrike, a cybersecurity ISV, exceeded the $1 billion mark via AWS marketplace sales. Others including Palo Alto Networks, Splunk and Snowflake are also part of the same league. In fact, businesses which are seeing 50-100%+ larger deals in cloud marketplaces as compared to other conventional sales channels.

“While cloud marketplaces are a great revenue driver for B2B ISVs, preparing and listing the offer is considered to be highly resource intensive, taking from a few weeks to a few months. Zero engineering and white glove onboarding with SaaSify makes marketplace listing a cakewalk, which ISVs can accomplish within a week, without any efforts!

This massive growth potential clearly indicates a trend with cloud marketplaces becoming an anchor channel for software sales in 2024 and other channels acting as support systems to create more buzz and manage long standing relationships.

Co-selling partnerships will bloom:

1/3rd cloud marketplace sales to be through channel partners by 2025

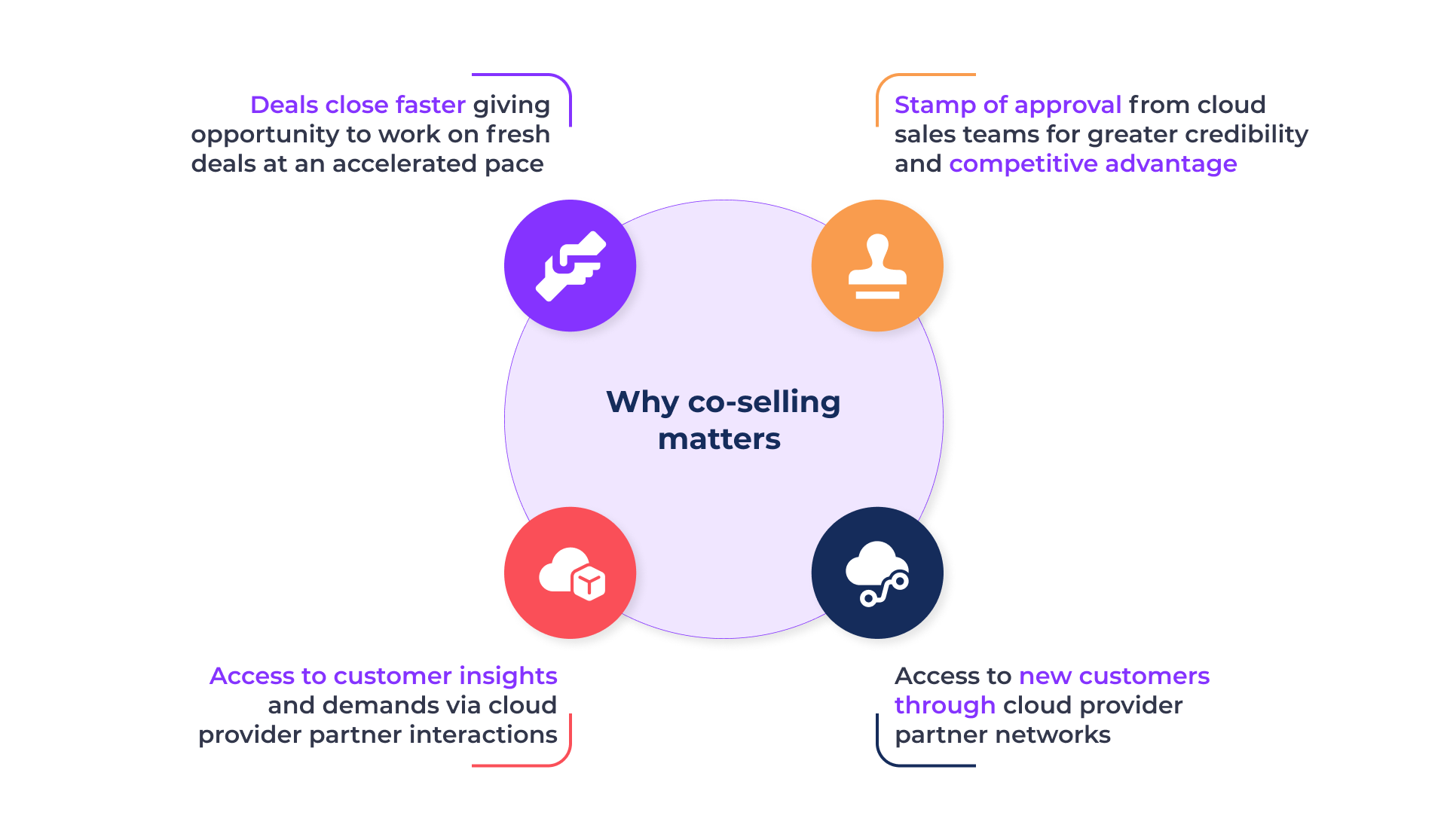

Co-selling or joint selling with cloud providers or channel partners, is poised to see a massive growth in the next few years, with a headstart in 2024. While many ISVs are already making use of co-selling programs and incentives, others are likely to get started this year. All hyperscalers enable ISVs to engage in co-selling in a variety of ways, including:

- Co-selling with cloud marketplace sales team: Here you work with the sales team of your cloud provider to jointly work on sharing leads, closing deals, etc. A major benefit of co-selling with cloud sales teams is increased visibility among marketplace customers, as well as insights into customer demands and needs, which field sales officials tend to have.

- Co-selling with other partners: There are other channel partners and resellers who ISVs can collaborate with for co-selling. Such partners take ISV’s marketplace listing to their end customers, as a private offer at a special rate. In a way, they act as an extended sales team for ISVs, helping them double the sales efforts. These partners might see ISV offerings as a good accompaniment or fit along with their core offering, making it a bundled deal for their end customers.

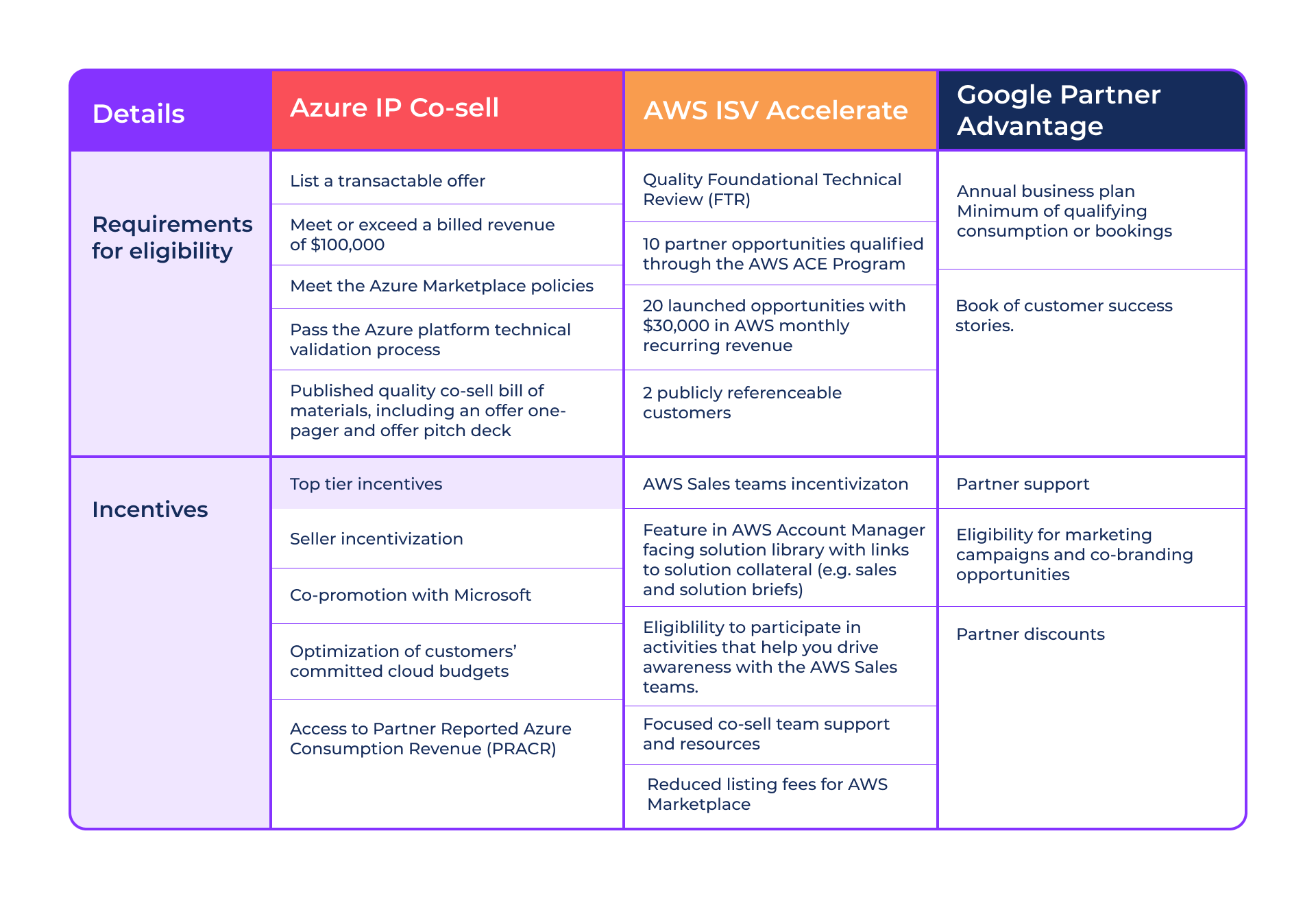

Co-selling with leading cloud marketplaces

Each cloud marketplace has its own set of requirements and benefits to ensure maximum return on investment when it comes to co-selling. It is advisable to check out the eligibility requirements, base benefits, additional criteria and some of the top tier benefits that you can unlock with co-selling.

- Azure IP Co-sell: Microsoft commercial marketplace’s co-selling program

- AWS ISV Accelerate: Co-selling program for AWS marketplace

- Partner Advantage: GCP marketplace’s co-selling program

Co-selling with channel partners

Co-selling in the cloud marketplaces can also be achieved through channel partners. The partners are authorized to sell products on cloud marketplaces. ISVs can authorize such partners to receive a wholesale or discounted pricing of their offer and the channel partner can then sell the same to their end customers.

In fact, research shows that by 2025, ⅓ of the sales in cloud marketplaces will be unlocked via channel partners

ISVs get an opportunity to enter into a new network of customers, that trust the channel partner, who generally understands the end customer’s business better, is equipped with localized knowledge and is a trusted partner for them. The process is quite simple, ISVs create a private offer with a discounted pricing, custom payout terms etc. for their channel or seller partner. Such offers are then extended to the customer by the channel or seller partner, who transacts or buys the offer through the marketplace. Finally, the cloud marketplace makes a payout to the ISV and the seller/ channel partner to close the loop. Here’s where the business benefit lies:

- 4,00,000+ partners are in the Microsoft ecosystem who can be potential seller partners for ISVs with the Multiparty Private Offers.

- 1,30,000+ partners are in the AWS marketplace ecosystem who can act as channel partners for the AWS Channel Partner Private Offers.

“Most co-selling deals with seller/ channel partners require a high degree of context switching between CRM and the cloud marketplace along with a steep learning curve for ISVs team. But SaaSify’s Salesforce Application has been excelling in releasing this tension, by helping ISVs automate the entire private offer lifecycle for seller/ channel partners from within Salesforce.

Create a winning co-selling narrative

While meeting the eligibility criteria and understanding the different co-selling options is important, it is equally important to build a compelling co-selling narrative which ISVs and their partners can use. Here is a template to build your co-selling story to win together:

What does your product do?

Briefly explain your product and how it is beneficial for the cloud provider in driving adoption and cloud consumption.

What problem does it solve for your partners’ customers?

Discuss the problem or specific challenges that your product seeks to address and the impact of these challenges on the customer’s business, and how that translates to cloud consumption.

What are the top features partners’ sales team can market?

Define how your product can help address the above mentioned challenges and how that will lead to tangible benefits for the cloud provider/ partner.

Who are your competitors and your competitive advantage?

Give a list of potential competitors in the market who may have a product similar to yours and how your product is a better fit. Try to incorporate how your product can help drive greater cloud consumption. Adding rankings, certifications can be beneficial.

How have you helped your existing customers?

Share some customer success stories and case studies to illustrate how you have already solved such customer challenges in the past.

A co-selling narrative has higher chances of success when it clearly defines how this partnership (ISV+ Cloud provider/ Seller partner), leads to value addition for the end customer. For greater understanding on co-selling, different programs, KPIs to track and much more, check out this detailed resource.

Transactable offers will take a lead

When it comes to listing and selling through cloud marketplaces, ISVs have two options. They can either create offers where transactions occur through the cloud marketplace or simply list their offers and conduct transactions outside the cloud marketplace. The former ones are called transactable offers.

And, 2024 is likely to see a massive increase in ISVs creating transactable offers over the other option. There are several factors guiding this shift. Originally, the transaction fee was kept at 20% of the deal size, which was considered too high. But some time back, this transaction fee saw a huge drop, coming down to only 3% of the deal size, a price that ISVs find easier to build into their listing expenses. At the same time, cloud marketplaces have kept their end of the promise of adding attractive incentives and benefits for ISVs, helping them increase the total value of their deals.

That’s not all, the last few months of 2023 also saw a few changes in how cloud marketplaces are positioning their transactable offers. Invariably, ISVs, with greater trust in cloud marketplaces and realizing the value they stand to unlock are jumping on the transactable bandwagon. Here are a few changes from the last two quarters.

Microsoft Commercial Marketplace

During its flagship event, Inspire, Microsoft announced that transactable offers are now a prerequisite for any ISV who seeks to become Azure IP Co-sell eligible and reap the associated co-selling benefits to extend customer reach, create offers that count towards a customer’s committed consumption, access GTM resources, etc.

This means that starting from January 1, 2024, transactable offers are a must for any ISV gearing up to co-sell with Microsoft. Undoubtedly, this move has already created an accelerated shift towards transactable offers which will further strengthen in 2024.

AWS Marketplace

AWS marketplace adopted a slightly different approach, but with the same goal, to make transactable offers more lucrative for ISVs. During AWS re:Invent 2023, modifications in AWS marketplace pricing structure were announced, lowering the threshold for certain categories of deals i.e.:

- 3% transaction fee for deals under $1 million

- 2% transaction fee for deals between $1 million and $10 million

- 1.5% transaction fee for private offers greater than $10 million

- 1.5% transaction fee for renewal fees for private software and data

With further lowering of the transaction fee, AWS marketplace ISVs have all the more reason to go transactable.

Overall, 2024 will be the year of transactable offers due to increased incentives on one side and greater ISV confidence in transacting through cloud marketplaces.

Accessing committed cloud consumption will be a business priority:

$300 billion in durable cloud budgets available

Right in the start of this whitepaper was the mention of $45 billion+ sales expected through cloud marketplaces. Despite economic turbulence and uncertainty, it is the committed cloud consumption that will be the primary driver of such exponential sales growth. Most enterprise businesses have committed cloud spend with their cloud providers and are looking to utilize the same for buying software to ensure cost optimization. In fact, studies show that close to half of the enterprise software buyers cite utilization of committed cloud budgets as a key driver purchasing software via cloud marketplaces.

$300 billion worth of durable cloud budgets are available across cloud marketplaces today, which ISVs can access by selling in cloud marketplaces.

There are several factors which are contributing to the rise of committed cloud spends. Put simply, these budgets come in place as a result of a contract between enterprises and cloud providers where the former commits to spending a sizable amount with the cloud provider and in exchange the latter provides enterprises with certain discounts and incentives. Such incentives are also accompanied by:

- Ease of scaling operations for enterprises in the cloud

- Multi-faceted collaboration opportunities with cloud providers

- Simplified and streamlined billing and procurement

Invariably, each cloud marketplace has created a strategic and robust committed cloud consumption program to help their customers better utilize committed budgets and ensure maximum return on investment. Here’s a quick snapshot:

The golden opportunity for ISVs

Pre-committed budgets create an unparalleled opportunity for ISVs to acquire new customers, facilitate renewals and even close bigger deals faster. Let’s look at each scenario:

New customer acquisition with committed cloud budgets

Pre-committed cloud budgets make it considerably easier for ISVs to attract and convert new customers as:

- These customers do not require any additional budgetary approvals for new software procurement, in fact, it can be projected as resource optimization. This also results in bigger deal sizes and faster closure rate.

- There is a higher level of trust as customers get the confidence of transactions being handled by their coveted cloud provider, and they don’t have to engage directly with another vendor, making procurement and invoicing streamlined

However, for ISVs to ensure they are able to access such committed cloud budgets, they should:

- Understand the preferred cloud provider for their customers and where they are most likely to transact on. This will help build eligibility for the committed cloud consumption program of that particular cloud provider to ensure access. For instance, to be eligible for the MACC program, ISVs must have a transactable offer in place as well as be Azure IP co-sell eligible.

- Identify and network with the cloud relationship team to understand the committed budgets available for spending. This can help ISVs create custom pricing and payout options to increase the chances of conversion.

Contract renewals with committed cloud consumption

If an offer is eligible to be counted as a part of a customer’s committed cloud budgets, renewals and even upgrades become seamless. On the one hand, since the renewal is already coming out of the budget committed, chances are that negotiations and repetitive pitches are less exhausting for ISVs. On the other hand, with committed budget utilization, the renewal process is completely seamless for customers, which significantly reduces churn as they don’t have to engage in paperwork, procurement and contracting, everytime renewal is due, which can be an operational nightmare.

Invariably, be it for new customers or renewals, accessing committed cloud consumption is significantly easier as it is seens as investments already made. ISVs can portray their offer as the best return on investment for customers, creating a case for financial prudence. At the same time, some cloud providers are also willing to provide their long standing enterprise customers with cloud credits when utilizing their committed consumption to offset a portion of the cost.

“In the current backdrop of economic turbulence, committed cloud consumption is the best bet for ISVs to scale cloud revenue, considering budgets for other channels might dry up, but cloud budgets are likely to see a consistent upward trend.

Automation will drive cloud marketplace scaling possible:

Save ~300 hours a year

The forecast up till now has been a reflection on the trends that ISVs can capitalize on to catalyze their B2B growth via the cloud marketplaces. However, in this last prediction, it is important to note that 2024 will see an increase in automation for cloud marketplace listing and selling. And, it will close the loop on all the predictions mentioned above, giving ISVs the route to capitalize on each one.

Research shows that companies (including ISVs) spend 200-300 hours every year on operationally heavy tasks which can be easily automated using the right tools

For ISVs, third party SaaS enablement platforms which help with listing, transacting and managing offer lifecycle can be huge business drivers. Invariably, their adoption will be a gamechanger for 2024. Here are the top reasons for adopting SaaS enablement and offer lifecycle automation tools:

Increased operational efficiency with SaaS enablement platform

From an operational efficiency perspective, a SaaS enablement platform can:

Facilitate 75% faster time to market via SaaS enablement platform

Listing an offer on cloud marketplaces can take place anywhere between 4-6 weeks, if not more due to the engineering changes, operational and technical readiness needed. But, a SaaS enablement platform can bring this down by over 75%, enabling ISVs to take their offers live in just a week.

Save 45% productivity lost due to context switching

Most ISVs have to switch and toggle between different cloud marketplaces, their CRM and dashboards to create offers, share private offers with customers based on CRM data, address customer concerns, etc. A SaaS enablement platform can help ISVs manage the entire offer lifecycle from within their CRM, saving 45% productivity often lost in the process of context switching. At the same time, it can prevent the 20% loss in cognitive capacity, faced during context switching.

Furthermore, context switching also pushes ISV teams to achieve a steep learning curve, which doesn’t add enough value, but does require a lot of bandwidth and is time and cost intensive. This additional resource inefficiency can be eliminated with the right SaaS enablement platform.

Greater sales productivity with SaaS enablement platform

When it comes to sales, a SaaS enablement platform can facilitate higher revenue with faster closures and better deals by:

Preventing 46% of sales inquiries which turn into missed opportunities

Often ISVs miss out on sales either because they take too much time to send out an offer to enterprise clients or because they do not closely track existing customers, leading to customer churn. However, with a SaaS enablement platform, most part of the offer management lifecycle can be automated and new customers can be onboarded within hours, greatly reducing their TTM as well. Furthermore, such platforms also help track each customer move in the cloud marketplace, enabling sales teams to derive insights to create the right renewal strategy and prevent any customer from falling through the cracks.

Facilitating 30% higher deal closure rate with Salesforce automation

Research shows that sales teams are able to close deals 30% faster with Salesforce automation. The right SaaS enablement platform comes with a Salesforce automation feature, reducing the sales cycle time by 18% with 14% additional savings of administrative time.

Robust reporting and insights with SaaS enablement platform

SaaS enablement platforms also open new avenues for reporting and insights facilitating:

10% higher year-over-year revenue growth with accurate forecasts

A SaaS enablement platform can equip ISVs with relevant customer data, tracking every customer move to identify the right opportunities for renewal, upgrades or any interventions that may be needed. At the same time, it can help predict revenue pipelines for the next accounting cycle with greater accuracy, resulting in 10% higher revenue growth.

“Clearly, 2024 will see a significantly higher adoption of SaaS enablement platforms with cross-cutting use cases for a higher return on investment.

2024 for ISVs: The way forward for SaaS selling

2023 has been an uncertain year both from a geopolitical and economic standpoint and the state for 2024 globally will remain dynamic. However, the growth of cloud and cloud marketplaces will be unfettered. Thus, here are some expert takeaways that ISVs can embrace for a more rewarding and value-oriented 2024:

- Drive organizational buy-in to build a presence on cloud marketplaces, build a presence on cloud marketplaces, because the time is now and the opportunity cost to ignore this channel can be huge. Start with converting executive acceptance and a leadership sponsor and then build business cases for each vertical across sales, operations, finance, alliances, etc.

- Make cloud marketplace your central strategy, instead of simply treating it as a good thing to have. Don’t just operate in silos, but build relationships with cloud providers. seller/ channel partners, etc. to cast a wide net for new sources of customers and net new revenue.

- List, transact and manage on cloud marketplace and go beyond using cloud marketplaces as a platform to only showcase your offer. Transact and leverage the cloud marketplaces’ revenue management services to not only streamline procurement, but also capture committed cloud consumption, which can significantly reduce your cost to sales.

- Automate with SaaS enablement platform, instead automate your workflows to unlock growth at scale. From operational teams, to sellers, to finance teams, identify workflows which can be automated and collaborate with the right partners to drive efficiency and optimization.

The time is NOW for ISVs to accelerate their operations on the cloud marketplaces. Moving beyond simply establishing a presence, it is important to explore transactable offers, build partnerships for co-selling and navigate through diverse cloud marketplace incentives like pre-committed cloud budgets, to meet and even exceed cloud marketplace revenue goals. A strategic and holistic cloud marketplace approach must be supported by automation via a SaaS enablement platform or a cloud marketplace integrator, enabling ISVs to focus on their core product and relationship building.

SaaSify, powered by zero-engineering capabilities, offer lifecycle automation, advanced integrations, robust and comprehensive reporting and one stop dashboard for offer and communication management, has been enabling leading Fortune 500 companies to list, transact and manage offers on top cloud marketplaces.

If you have any questions of the forecast and predictions shared above, or you want to learn more about the best practices to accelerated your cloud marketplace journey, Get in a touch with a SaaSify experts today.

Scott Smith

“SaaSify supported Willow in making our WillowTwin solution commercially transactable in Azure Marketplace. We found the team extremely responsive and supportive, ensuring actions were followed up and commitments were met on time.”

Scott Smith

“SaaSify supported Willow in making our WillowTwin solution commercially transactable in Azure Marketplace. We found the team extremely responsive and supportive, ensuring actions were followed up and commitments were met on time.”

Book a Free Demo!

Join 100+ ISVs using SaaSify to Power Marketplace Sales

Scott Smith

“SaaSify supported Willow in making our WillowTwin solution commercially transactable in Azure Marketplace. We found the team extremely responsive and supportive, ensuring actions were followed up and commitments were met on time.”

Scott Smith

“SaaSify supported Willow in making our WillowTwin solution commercially transactable in Azure Marketplace. We found the team extremely responsive and supportive, ensuring actions were followed up and commitments were met on time.”

Scott Smith

“SaaSify supported Willow in making our WillowTwin solution commercially transactable in Azure Marketplace. We found the team extremely responsive and supportive, ensuring actions were followed up and commitments were met on time.”

Scott Smith

“SaaSify supported Willow in making our WillowTwin solution commercially transactable in Azure Marketplace. We found the team extremely responsive and supportive, ensuring actions were followed up and commitments were met on time.”

Read MoreReject AllAccept

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |