Independent Software Vendors (ISVs) have discovered the power of hyperscaler marketplaces. AWS, Azure, and Google Cloud aren’t just distribution channels anymore, they’re multi-billion-dollar growth engines where enterprises procure SaaS solutions using pre-committed cloud budgets.

For ISVs, this means faster deal cycles, larger contracts, and the halo effect of being backed by hyperscalers. But there’s a catch: the operational complexity behind the scenes.

Today, most RevOps teams manage marketplace workflows with a messy combination of:

- Spreadsheets for deal tracking, claims, and forecasts

- CRMs (Salesforce, HubSpot) for core revenue operations

- Marketplace portals (AWS, Azure, GCP) for publishing, private offers, and claims

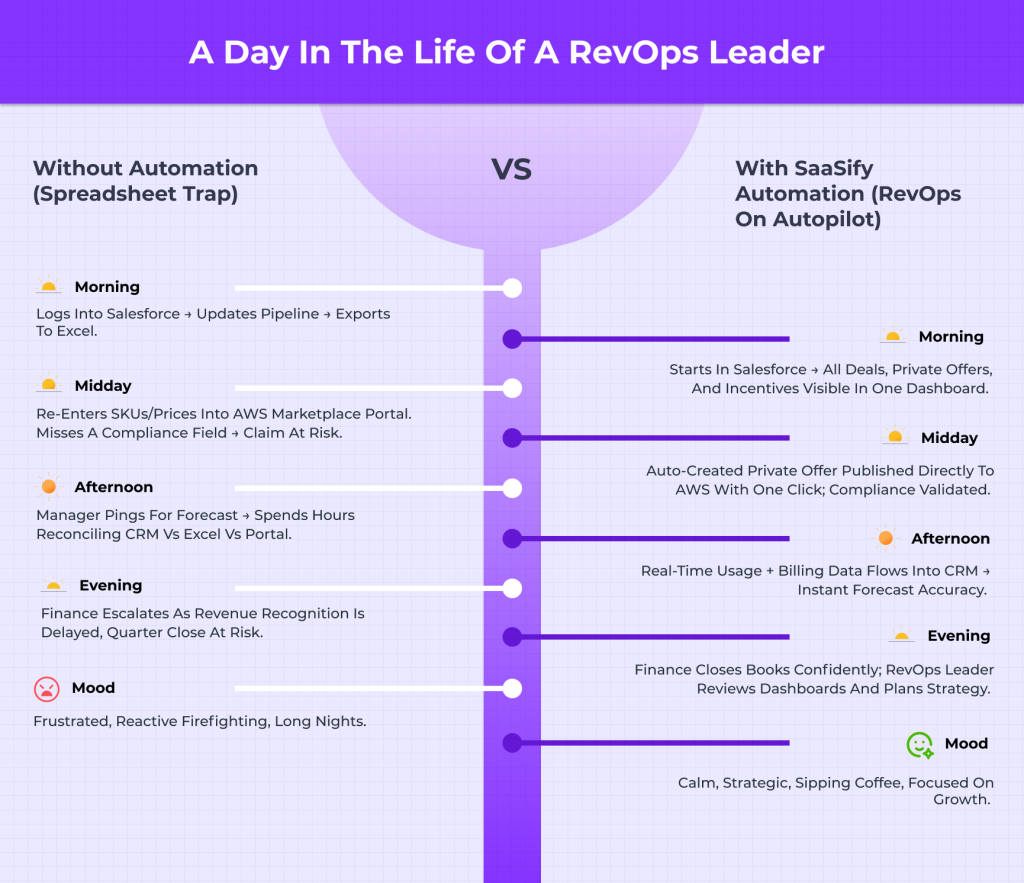

The result? Endless context switching between three disconnected environments. An analyst might start in Salesforce, jump to an Excel tracker, then switch to the AWS Marketplace portal, only to return to the spreadsheet to reconcile updates. This constant back-and-forth is not just inefficient; it’s error-prone and exhausting.

Spreadsheets became the default “glue” to hold all this together, However, they were never designed for hyperscaler RevOps. And as deal volumes scale, the glue starts to crack.

TL;DR – RevOps on Autopilot

- ISVs selling on AWS, Azure, and GCP marketplaces face massive operational drag from context switching between CRMs, spreadsheets, and hyperscaler portals.

- Manual workflows lead to errors, compliance misses, revenue leakage, and slow deal cycles.

- SaaSify ends this chaos by making marketplace RevOps CRM-native, automated, and AI-enabled.

- Result: 2–3x faster deals, zero spreadsheet dependency, real-time revenue recognition, and accurate forecasting.

The Spreadsheet and Context Switching Trap in Hyperscaler RevOps

When ISVs first started selling on AWS, Azure or GCP marketplaces, the transaction volumes were low. A few deals a month could be tracked manually. Finance and ops teams used Excel as the connective tissue between CRMs, marketplace portals, and finance systems.

But this created triple-handling of data:

- Opportunity created in Salesforce

- Copied into spreadsheets for internal tracking

- Re-entered into AWS, Azure or GCP marketplace portals

Every cycle multiplied the risk of error and wasted time, creating an operational tax that grows heavier as ISVs scale with diverse challenges, including:

Version Chaos

Multiple team members maintain parallel Excel files for deals, offers, and claims. Reconciling “Pipeline_vFinal.xlsx” with “Pipeline_vFinal_2NEW.xlsx” is error-prone and time-consuming.

Error Magnification

- Copy-paste mistakes in spreadsheets inflate or underreport revenue.

- Wrong SKU inputs or pricing mismatches occur when re-entering data into marketplace consoles.

- CRM records often go out of sync with what’s in the portal or the tracker.

Excessive Context Switching

- RevOps teams jump between Salesforce, Excel trackers, and AWS/Azure/GCP portals multiple times for each deal.

- Each switch adds friction, slows down workflows, and creates more opportunities for mistakes.

- Instead of one connected workflow, RevOps lives in three siloed systems.

Slow Deal Desk Turnarounds

Private offers and co-sell requests require ops managers to validate data across CRM, spreadsheets, and portals. What should be minutes of work becomes hours or days.

Compliance Blind Spots

Incentive programs like AWS ACE, Azure Co-Sell, GCP Partner Advantage require precise documentation. Spreadsheet-based tracking often misses key compliance fields, while portal-only workflows lack a connected audit trail, leading to delayed or rejected claims.

No Scalability

At 5 deals a month, manual tracking across CRM, spreadsheets, and portals is “good enough.” At 50 or 500, it collapses. Headcount increases, but efficiency doesn’t, because the underlying problem is structural, not operational.

Revenue Recognition Delays

Finance teams depend on spreadsheets as the “system of record.” Reconciling CRM opportunities with marketplace payouts can take weeks, delaying month- and quarter-end closes. Audit readiness suffers.

Relying on spreadsheets while constantly switching between CRM and marketplace portals doesn’t just waste time, it actively limits scale.

How SaaSify Automates RevOps on Autopilot

SaaSify enables ISVs to run RevOps on autopilot by automating the most complex and time-consuming workflows across quoting, private offers, incentives, billing, and forecasting. Instead of managing disconnected spreadsheets and jumping between CRM and marketplace portals, everything happens seamlessly within Salesforce or HubSpot.

Quoting & Private Offers

With SaaSify, quoting is marketplace-aware and CRM-integrated. Teams can automatically convert CRM objects to quotes that are automatically formatted to meet AWS, Azure, and GCP requirements, including SKUs, billing terms, and pricing models. Multi-step approvals are routed inside CRM with SLA tracking, audit trails, and versioning, ensuring both compliance and speed.

Once a quote is approved, it can be converted directly into a private offer with payout schedules, terms, and conditions. SaaSify publishes the offer to the hyperscaler marketplace without the seller ever leaving CRM. The status of the offer, creation, acceptance, renewal, is updated in real time in the CRM dashboard. Expiry alerts, automated renewals, and audit-ready logs ensure offers are managed proactively.

Incentive & Compliance Workflows

SaaSify brings AWS incentives and funding programs like MDF, POC credits, and Jumpstart directly into CRM workflows. Instead of juggling spreadsheets and emails, ISVs get:

- Unified visibility of all funding requests with program type, amount, stage, and owner

- Real-time sync between AWS portals and Salesforce/HubSpot

- Full activity history with updates, comments, and logs

- Automated collaboration across GTM, Finance, and Partnerships teams

The result is faster approvals, fewer errors, and stronger alignment with AWS account teams. Upcoming capabilities will even enable ISVs to initiate, submit, and track funding requests end-to-end inside CRM, with auto-populated forms, reminders, and ROI tracking.

Metering, Billing & Revenue Recognition

SaaSify integrates directly with AWS, Azure, and GCP billing systems to automate metering and revenue workflows. Usage data flows into CRM dashboards in real time and is mapped against private offers and contracts. Commit balances are tracked continuously, allowing teams to see how much of a customer’s committed spend has been drawn down.

Billing data is automatically reconciled in the CRM for finance systems, aligning with hyperscaler payout cycles and regional tax requirements. This accelerates revenue recognition, eliminates leakage, and ensures compliance across geographies.

Forecasting & Revenue Intelligence

SaaSify brings all revenue data into a single pane of glass. CRM, marketplace transactions, billing, usage, and co-sell data are consolidated into dashboards tailored for Sales, Finance, Partnerships, and Leadership. Forecasts are based on live consumption trends, contract terms, and payouts, not static spreadsheet models.

RevOps leaders can attribute revenue accurately across cloud-sourced, influenced, and closed deals, track renewals tied to usage patterns, and measure partner impact on win rates. This unified visibility ensures leadership alignment and precise forecasting.

By automating RevOps end-to-end, SaaSify delivers measurable outcomes:

- Faster deal velocity with automated quoting and private offer publishing

- Accurate incentive recovery with compliance-validated claims

- Real-time billing and revenue recognition with no leakage

- Predictable forecasts and renewals with usage-based intelligence

- Lower operational overhead by eliminating spreadsheets and manual reconciliations

SaaSify transforms RevOps from manual execution into a strategic, automation-first function that scales revenue impact across AWS, Azure, and GCP.

Manual vs Automated RevOps: A Comparison

| RevOps Function | Manual Process | SaaSify Automated Workflow |

|---|---|---|

| Deal Desk Approvals | Manual validation across CRM + sheets + portals | Automated routing, CRM-native approvals |

| Private Offer Creation | Copy-paste SKUs into AWS/Azure consoles | Auto-create offers from CRM with a few clicks |

| Incentive & MDF Claims | Manual claim prep, missed compliance fields | Pre-filled, validated, auto-submitted claims from CRM |

| Metering & Usage Data | Export raw usage, massage in Excel, re-enter into billing | SaaSify pulls and validates metering data, syncs data between CRM and hyperscaler portal |

| Billing & Revenue Recognition | Spreadsheets reconcile CRM vs. portal payouts | Automated reconciliation + revenue recognition within CRM |

| Forecasting | Static Excel models, updated weekly | Live dashboards with predictive intelligence within CRM |

Implementation Playbook: 90 Days to RevOps on Autopilot

Transitioning from spreadsheets to SaaSify’s automation can be phased in smoothly.

Days 1–30: Foundation & Setup

- Connect Salesforce/HubSpot with SaaSify to centralize quoting, offers, and funding.

- Baseline KPIs: deal velocity, approval cycle time, claim recovery, forecast accuracy.

Days 31–60: Expansion & Automation

- Facilitate private offer and co-sell automation in CRM.

- Configure billing and metering integrations.

- Roll out SLA-driven approvals across Sales, Finance, and Partnerships.

Days 61–90: Scale & Intelligence

- Automate reconciliation of billing and revenue recognition with hyperscaler payout cycles.

- Use SaaSify dashboards for live forecasting (within your CRM) and ROI visibility across AWS, Azure, and GCP.

- Sunset spreadsheet-based processes and move RevOps fully into CRM-native automation.

Outcome: By Day 90, RevOps functions, from quoting to billing to incentives, are running on autopilot, automated from within your CRM.

KPI Framework: Measuring the Autopilot Impact

Deal Execution

- Deal Velocity – Time from opportunity to closed-won (target: 2–3x faster)

- Private Offer Cycle Time – From quote approval to offer acceptance via CRM (cut from days to minutes)

- Co-Sell Win Rate – % of opportunities closed with hyperscaler alignment

Billing & Revenue

- Metering Accuracy – % of usage records reconciled automatically

- Revenue Recognition Lag – Delay between deal closure and recognition (aligned to hyperscaler payouts)

- Forecast Accuracy – Variance between forecasted and actual revenue

- Marketplace ROI- Total revenue generated through marketplace channels against operational costs

Operational Efficiency

- Ops Efficiency Ratio – Deals managed per RevOps headcount

- Spreadsheet Dependency – % of workflows outside CRM (goal: 0%)

- Data Accuracy Score- Data consistency across CRM, marketplace portals, and billing systems

- System Adoption Rate- Active usage of automated tools across revenue teams

- Team Productivity- Revenue per employee metrics and time allocation to strategic activities versus administrative tasks

Roadmap to RevOps on Autopilot

| Phase | Focus | What Happens | Outcome |

|---|---|---|---|

| 1. Stabilize | Gain control of fragmented data & processes | Centralize deal, offer, billing, and claim data; establish baseline KPIs for accuracy & velocity | Visibility improves, but operations remain manual-heavy |

| 2. Automate | Replace manual tasks with workflows | CRM integrates with marketplace portals; automate quoting, private offers, billing, and claims | Deal cycles shorten, errors reduce, and revenue capture increases |

| 3. Optimize | Move from execution to efficiency | Standardize co-sell tagging & attribution; automate incentive utilization; forecasting uses live data | Forecast accuracy improves, hyperscaler alignment strengthens, RevOps becomes proactive |

| 4. Scale | Expand automation across hyperscalers | Extend processes across AWS, Azure, GCP; cross-functional adoption across Sales, Finance, Partnerships, CS | Revenue scales without linear headcount growth; RevOps supports global GTM at scale |

| 5. Autopilot | Transition to automated RevOps | Automated reconciliation, offer management, forecasting, billing, and compliance from CRM | RevOps becomes a predictable growth engine: CRM-native, AI-enabled, hyperscaler-aligned |

The transformation from spreadsheet chaos to RevOps autopilot isn’t just an operational upgrade, it’s a competitive advantage that enables revenue teams to scale efficiently while cloud marketplace opportunities continue expanding. With SaaSify’s comprehensive automation platform, organizations can finally realize the full potential of cloud marketplace selling without the operational overhead that traditionally constrained growth.

Book a demo with SaaSify experts today to explore how RevOps automation can transform your marketplace operations and accelerate revenue growth.

FAQs

1. Why is context switching such a big issue in marketplace RevOps?

Because RevOps teams work across three disconnected environments, CRM, spreadsheets, and hyperscaler portals. Each switch adds friction, slows down processes, and increases the risk of errors or missed compliance details.

2. How does RevOps on autopilot improve alignment with hyperscaler account teams?

Automated co-sell tagging, real-time pipeline visibility, and integrated incentive management within CRM ensure that AWS, Azure, and GCP teams can collaborate without delays or manual data sharing.

3. What role does RevOps play in maximizing cloud commit utilization?

RevOps ensures private offers and billing are aligned with customer cloud commits. With automation, teams can continuously track drawdowns, preventing underutilization and lost revenue opportunities.

4. How does automating incentive management affect MDF and funding programs?

By managing MDF and AWS-sponsored funding directly inside CRM, RevOps eliminates manual submissions, reduces turnaround time for approvals, and ensures full compliance with program requirements.

5. What kind of revenue leakage occurs in manual RevOps setups?

Leakage happens when metering data isn’t reconciled correctly, billing cycles are delayed, or incentive claims are rejected due to errors, leading to lost revenue that automation can recover.

6. How does RevOps automation improve forecasting accuracy?

Automation pulls live consumption, billing, and pipeline data into CRM dashboards. This transforms forecasting from static spreadsheet models into predictive insights that reflect real-time usage and payouts.

7. What are the risks of keeping RevOps processes on spreadsheets as ISVs scale?

At scale, spreadsheets lead to version chaos, incorrect SKUs, missed renewals, delayed claims, and compliance blind spots, all of which create operational drag and limit marketplace growth.

8. How does RevOps automation impact finance teams specifically?

Finance teams benefit from automated billing reconciliation, faster revenue recognition, tax and compliance alignment, and real-time visibility into hyperscaler payout cycles.

9. Can RevOps automation support multiple hyperscalers at once?

Yes. Automation allows ISVs to unify workflows across AWS, Azure, and GCP removing the need for separate processes and giving leadership a consolidated view of marketplace performance.

10. What’s the long-term value of shifting to RevOps on autopilot?

Beyond efficiency gains, RevOps on autopilot turns marketplace operations into a predictable growth engine, accelerating deal velocity, strengthening hyperscaler partnerships, and scaling revenue without proportional headcount increases.